The Honest Buck

February 26, 2018

The Honest Buck: Today’s Game Changer

by Rishab Rao

“Your most unhappy customers are your greatest source of learning.” – Bill Gates

Don’t like the game, change the board!

Competitors are as old as commerce itself. Tradesmen and businesses have continuously had to answer the question “What can I do differently to beat the competition?”, very cognizant of the fact that their competitors are likely doing the same. Traditionally the business that offered its customers the greatest value for their buck usually won out. This free market competition encouraged businesses to become ever more innovative in their offering of value to their customers. Innovation takes effort, but in order to survive it was necessary. The businesses that innovated continuously thrived and the customers benefited. Today’s landscape, however, is nowhere nearly as linear. The gameboard is entirely different and innovation has become unnecessary for survival, unfortunately to the detriment of the customer.

The Rot Within

We are witnessing the emergence of some of the largest corporations the world has ever seen. These companies generate more revenue than the entire Gross Domestic Product (GDP) of some nations; numbers that would make an industrial era business owner stagger in awe. A testament to the free market in which we live, these goliath corporations have often appeared in case studies and conversations as paradigm examples of successful growth. However, growth of this magnitude is a double-edged sword, bringing with it a new level of sustainability challenges and the very real threat of disruptive innovation1. Still, propelled by the momentum of previous successes, these looming threats are viewed as too distant or far-fetched and are often ignored or taken too lightly.

Evidence of the creeping rot within begins to manifest in a variety of ways: first with dissatisfied customers and employees followed by bursts of bad press and even ire from consumers and consumer advocacy groups. Consider the following examples:

- Walmart ($485 bn. Revenue 20172) underpays their employees and limits full-time employment, resulting in some employees supplementing their income with public assistance programs.3

- Volkswagen Group ($264 bn. Revenue 20174) built certain models to “cheat” on emissions tests, allowing consumers to believe they were driving a car that didn’t exceed emissions requirements and didn’t subsequently damage the environment.5

- Apple Inc. ($228 bn. Revenue 20176) purposely caused the iPhone to slow down over time to “encourage” consumers to upgrade to a new phone model.7

- Large banks such as JPMorgan Chase ($102 bn. Revenue 20178, $2.6 tr. Assets9) and Bank of America ($88.2 bn. Revenue 201710, $2.3 tr. Assets11) manipulate the order of transactions in order to maximize the potential of triggering overdraft fees12.

- Verizon ($126 bn. Revenue 201713) and AT&T ($160 bn. Revenue 201714) sell their customers’ browsing history without their customers’ express knowledge. Additionally, studies have shown that the internet speeds they supply are slower than what most customers are paying for15.

Yes, companies go into business to make money, and companies that make a lot of money have happier owners and shareholders but not necessarily happier employees or customers. Why are these gigantic corporations’ business models dependent on underpaying employees, or duping, confusing, and selling out their customers? When did businesses decide it was perfectly acceptable to make money by relying on their customers’ naiveté, ignorance, or plain exhaustion to fight back?

This is not an exchange of value for payment. Whatever happened to making an honest buck? Incredibly, even after these customer unfriendly practices are brought to light, some of the companies continue with these practices. Why? Because they can, and it’s easier than making an honest buck.

Innovation Stagnation

Let’s face it, the truth is that the majority of “successful” companies have stopped innovating, and worse, are not as focused on increasing value for customers as they are on the next quarter’s earnings. The pressure to bring in higher profits is constant and never ceasing. Studies in human cognitive behavior suggest that to relieve pressure, humans tend to seek out the path of least resistance16 to achieve the objective, and corporations are no different. Innovation takes effort, and for large corporations with clout and resources, innovation is NOT the path of least resistance.

What happens when you take the lazy way out? For an individual, it might mean being stuck in a dead-end job or becoming overweight due to lack of exercise. For a company, the repercussion is a failure to innovate and too much reliance on past success. This leads to a rapid degradation of innovative capability. A culture of innovation is like any musculature. If it isn’t exercised it atrophies. Huge corporations such as mentioned above – as well as many more businesses of all sizes – struggle to simultaneously manage the business well during periods of growth and keep coming up with the next innovation or incremental unit of value for the customer. At this juncture the path of least resistance typically leads to less than admirable business practices. The inability to produce innovative offerings that add value for the customer coupled with underhanded business practices results is unsatisfactory products, service, and support for current customers and a lack of appeal to new customers.

This condition is not sustainable for any company, of any size, and any growth in profits will prove to be temporary. The greater the stagnation of new value and the more cornered the customers feel, the more disgruntled and disillusioned they become, and the more fertile and ripe the market becomes for disruption. Thus, these businesses have a choice – disrupt themselves or be disrupted by someone else. This is inevitable and only a matter of time.

Innovative capability, customer satisfaction, and voluntary customer loyalty must be considered when determining the true success of a company. Is your customer base present because they are loyal to your brand or is it that they can’t wait for your contract with them to expire? Perhaps they are present because you are currently the only game in town? So why should you care if your customer base is satisfied or voluntarily loyal? Because a good measure of innovative capability is whether your business can be easily disrupted. If you ignore customer dissatisfaction and your business model still relies on cornering customers into unhappily giving you their money, you are unwittingly, yet ardently, enriching the industry for easy disruption.

The Disruptive Advantage

The good news: in the age of stagnating giant corporations, making an honest buck matters more than ever. The more innovative your product and service offering, and the more honest your business model is, the greater your ability to disrupt the industry and the sooner you will do it. Challenge yourself to innovate and truly deliver greater value to your customers. It is not as difficult as often believed once value for customers is made a priority. Keep in mind that innovating can be simple. It often does not equate to herculean leaps ahead, but rather incremental and steady steps forward. Focusing and improving on just a few attributes of the customer’s experience with your product or service can lead to game-changing results.

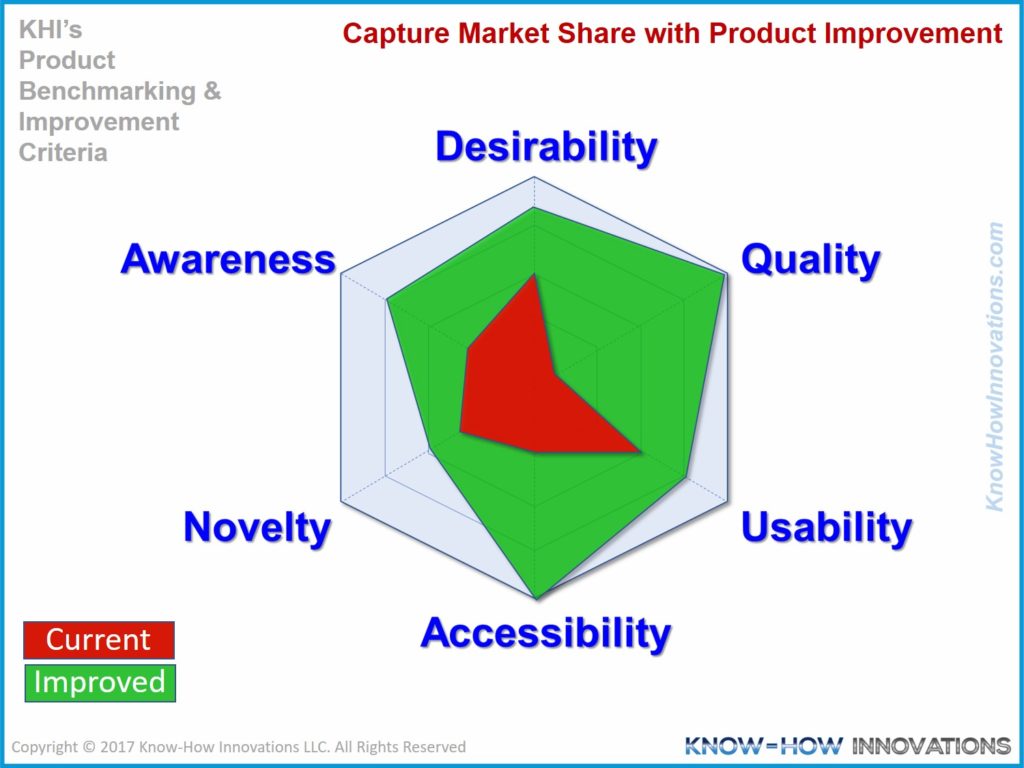

Source: Product Improvement for Market Growth

Make your value offering an oasis for customers in this arid desert marketplace preyed on by scavenger business practices that erode customer loyalty to the bone. Your customers are clearly able to discern value from dishonest tactics, and if you offer them increasing value they will give you growth. Accordingly, your customers will disrupt the industry for you by adopting your products over the competitor’s. Remember, in the end your customers build your brand. All you can do is offer them reasons to do so.

References:

- https://hbr.org/2015/12/what-is-disruptive-innovation

- https://www.marketwatch.com/investing/stock/wmt/financials/

- https://www.forbes.com/sites/clareoconnor/2014/04/15/report-walmart-workers-cost-taxpayers-6-2-billion-in-public-assistance/#3eb2aef720b7

- https://www.reuters.com/article/us-volkswagen-vehicleregistrations/vw-2017-group-sales-rose-to-around-10-7-million-cars-beating-toyota-bild-am-sonntag-idUSKBN1EV0R7

- https://www.theguardian.com/business/ng-interactive/2015/sep/23/volkswagen-emissions-scandal-explained-diesel-cars

- https://www.marketwatch.com/investing/stock/aapl/financials

- https://www.theguardian.com/technology/2017/dec/29/apple-apologises-for-slowing-older-iphones-battery-performance

- https://seekingalpha.com/article/4137324-jpmorgan-chase-and-cos-jpm-ceo-james-dimon-q4-2017-results-earnings-call-transcript, https://seekingalpha.com/symbol/JPM/earnings

- https://www.jpmorganchase.com/corporate/investor-relations/pr/4q17-and-full-year-2017-earnings-010218.htm

- http://investor.bankofamerica.com/phoenix.zhtml?c=71595&p=quarterlyearnings#fbid=zHlVvY4kRLJ

- https://www.relbanks.com/top-us-banks/assets

- https://www.forbes.com/sites/halahtouryalai/2012/02/22/are-banks-manipulating-your-transactions-to-charge-you-an-overdraft-fee/#575cdc71376a

- https://www.marketwatch.com/investing/stock/vz/financials

- https://www.marketwatch.com/investing/stock/t/financials

- https://www.theguardian.com/technology/2015/jun/22/major-internet-providers-slowing-traffic-speeds

- https://www.psychologytoday.com/blog/the-gen-y-guide/201703/were-wired-take-the-path-least-resistance